Tax Law Highlights: 2026

Related Tax Information for 2026 That Could Impact You

With a new year comes change, including updates from the IRS to the standard deduction and charitable contribution limits. These changes are a not-so-subtle reminder from the IRS of the importance of incorporating a charitable-giving strategy into any wealth or tax planning for the year.

Depending on what 2026 will look like for you, there may be ways to make an extraordinary impact on the causes you care about while potentially lessening your taxable liability. Below are the most notable IRS changes to the standard deduction, estate tax, and more from 2025 to 2026. The tax year 2026 adjustments described below generally apply to tax returns filed in 2027. The tax items for tax year 2026 of greatest interest to most taxpayers include the following dollar amounts:

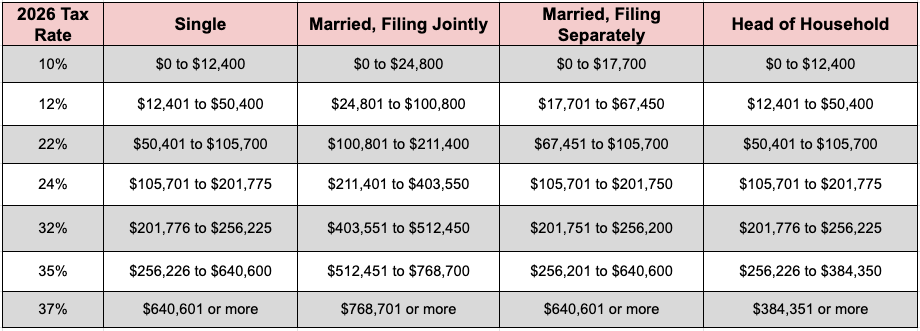

2026 Tax Bracket & Federal Income Tax Rates

2026 Standard Deductions

For tax year 2026, the standard deduction increases to $32,200 for married couples filing jointly. For single taxpayers and married individuals filing separately, the standard deduction rises to $16,100 for tax year 2026, and for heads of households, the standard deduction will be $24,150.

(Additionally, for tax year 2025, the OBBB raises the standard deduction amount to $31,500 for married couples filing jointly. For single taxpayers and married individuals filing separately, the standard deduction for 2025 is $15,750, and for heads of households, the standard deduction is $23,625.)

Marginal Tax Rates*

For tax year 2026, the top tax rate remains 37% for individual single taxpayers with incomes greater than $640,600 ($768,700 for married couples filing jointly). The lowest rate is 10% for single individuals with incomes of $12,400 or less ($24,800 for married couples filing jointly).

*After 12/31/2025 marginal tax rates, aside from the first two brackets (10% and 15%), will be determined differently than under the Tax Cut and Jobs Act (TCJA) and return to the pre-TCJA levels (2017). Those ranges will also be adjusted for inflation.

Alternative Minimum Tax

For tax year 2026, the exemption amount for unmarried individuals is $90,100 and begins to phase out at $500,000 ($140,200 for married couples filing jointly for whom the exemption begins to phase out at $1,000,000).

Estate Tax

For qualifying taxpayers who have three or more qualifying children, the tax year 2026maximum Earned Income Tax Credit amount is $8,231, an increase from $8,046 for the tax year 2025. The revenue procedure contains a table providing the maximum EITC amount for other categories, income thresholds, and phase-outs.

Gift Exclusion

The annual exclusion for gifts remains at $19,000 for the calendar year 2026. The charitable contribution limit for a gift of cash to a public charity or donor-advised fund remains 60% of one’s adjusted gross income (AGI), and the limit for non-cash gifts remains 30% of AGI.

Capital Gains Tax Rates and Brackets

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

Long-term capital gains face different brackets and rates than ordinary income.

Capital Gains Tax Brackets

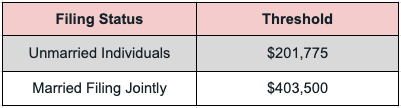

Qualified Business Income Deduction

The Tax Cuts and Jobs Act of 2017 (TCJA) includes a 20 percent deduction for pass-through businesses. Limits on the deduction begin phasing in for taxpayers with income above $201,775 (or $403,500 for joint filers) in 2026.

2026 Qualified Business Income Deduction Thresholds

Your charitable donations are tax-deductible. The ministry’s tax identification number is 95-6006173. Jesus Film Project® is a ministry of Campus Crusade for Christ International®. The ministry operates under the brand name Cru® in the United States.

Jesus Film®