10 Benefits of a Cru Foundation® Donor-Advised Fund

Get even more out of these flexible and powerful accounts!

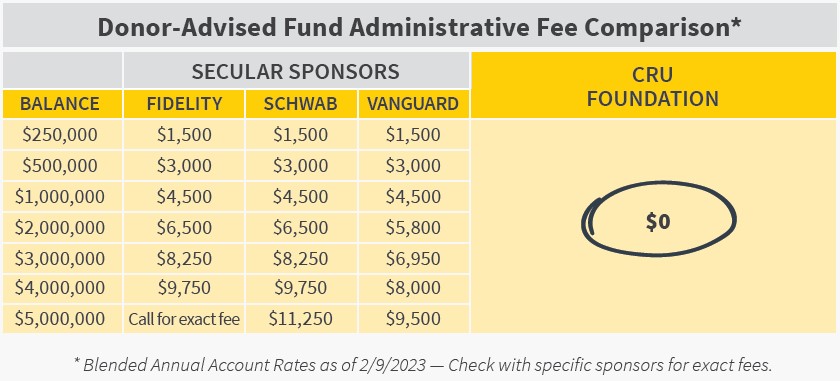

Now With No Administrative Fees!

You may be familiar with the convenient and effective giving vehicle called a Donor-Advised Fund—and you may know of the basic benefits that make them so popular: tax savings, streamlined giving and easier record keeping. You can use a Cru Foundation Donor Advised Fund to make grants to Cru®, your church or any other charitable organization. All good things.

But many people don’t realize there are additional ways to get even more out of these flexible and powerful accounts …

Let’s run down 10 overlooked ways to make your charitable dollars work harder for you and the kingdom through your investment in a Cru* Foundation (donor-advised) Fund:

1. Get a double tax savings. You may be aware that donating appreciated stock rather than cash to your CF not only provides an income tax deduction, but it also shelters the stock from long-term capital gains taxes. Often, those appreciated stocks are your best performers and you want to keep them charging ahead. At those times, you might be tempted to give cash. Instead, consider giving the stock and simultaneously purchasing the same number of shares with the cash you would have donated. That way, you can still take advantage of the double tax savings, but you have the added benefit of maintaining an identical stock position. You also reset the cost basis on those appreciated shares to zero—a tax advantage for you should you need to sell the shares. Keep in mind, “wash sale” rules do not apply to donated shares.

2. Pass your values to your children and grandchildren. Create a committee that involves your children or grandchildren and invite them to recommend grant ideas. As the chair of the committee, you can establish criteria for grants and allow others to find worthy kingdom causes. Group discussions and deliberation allow you to communicate your family values through word and deed, and give others the opportunity to do likewise. Prepare the future chair or co-chairs of the committee and name them the successor adviser(s) of your CF.

3. Operate your own “private foundation” without the hassle and expense. Many donors with private foundations have learned that a CF can accomplish their goals, but without the following headaches: filing tax returns; disclosing grants, investment fees, trustee names and staff salaries; start-up costs; expensive maintenance; administrative burdens like asset management and maintaining board minutes; and being subject to excise taxes. Perhaps best of all, CF contributions provide higher deductibility limits that allow for greater leverage of God’s resources.

4. Leverage your appreciated assets. Donating appreciated assets into a CF saves on both income and capital gains taxes. Other types of appreciated assets, like real estate or business interests, can be put in a CF for the same benefit. It also makes distribution of the assets easier, especially if you want to support multiple ministries or need time to figure out where to give.

5. Harness tax-free growth. Unlike investments in a brokerage account, funds in a CF are not subject to capital gains taxes. That means the investment growth inside of a CF can be harvested tax-free. A CF can be set up to work like an endowment so that principal is invested for long-term growth and returns on principal can be redeemed for granting.

6. Time your distributions for greater effectiveness. Increase your impact by offering a matching or challenge gift to your ministry. With a CF you can meet tax deadlines now while giving your ministry time to raise matching funds. Or use your CF to distribute gifts over time to allow the ministry to forecast, make plans and adjust. Or set up a company fund to match employee giving.

7. Form a giving circle. A CF allows you to pool funds with like-minded friends who are passionate about ministry. By combining contributions into one larger effort, you and your friends can have the satisfaction of “moving the needle” on an important project. Uniting around goals and a giving strategy is a great catalyst for deeper fellowship and generosity.

8. Protect your privacy. A CF can protect you, your family and your business from unwanted public attention, whether it be positive or negative. Individual donor names can be kept confidential and grants can be made anonymously.

9. Create a memorial fund. You can name a CF after an honored family member or friend so that it serves as a tribute or memorial fund. Because anyone may make tax-deductible gifts to your CF, this can be an excellent place to collect “in lieu of” contributions. The foundation does the receipting for you, and you can decide what grants to recommend later.

10. Add flexibility to your estate giving. Your CF can be made the recipient of assets you plan to give to charity. This could be especially helpful if you prefer your donations to be designated to specific projects or to where most needed at that time. By putting testamentary funds in a CF, your successor adviser will evaluate the best designation for your gifts. If a program or project is no longer relevant or effective, they may choose something more appropriate. The successor adviser could be your executor, or anyone you trust to make decisions in accordance with your values.

Administrative Fees: They’re Not All The Same

The hour is urgent. The needs are great. You are generous. That’s why we have eliminated administrative fees on Cru Foundation (donor-advised) Funds. As the chart below shows, administrative fees can add up to thousands of dollars that could go to kingdom work. John the Baptist declared, “Make a straight path for the Lord to travel.” We think that includes obstacles to giving. As our partner in the mission, we want to offer this benefit to you. If you want lower fees, call us today.

For many families and individuals, the Donor-Advised Fund is fast becoming the desired planning option of choice. You can open a Cru Donor-Advised Fund with an initial gift of $5,000 or more. Start the process now, click here to print the application form.

Contact us at 800-449-5454 or [email protected] and learn more about how you can open a fund today.

Jesus Film®